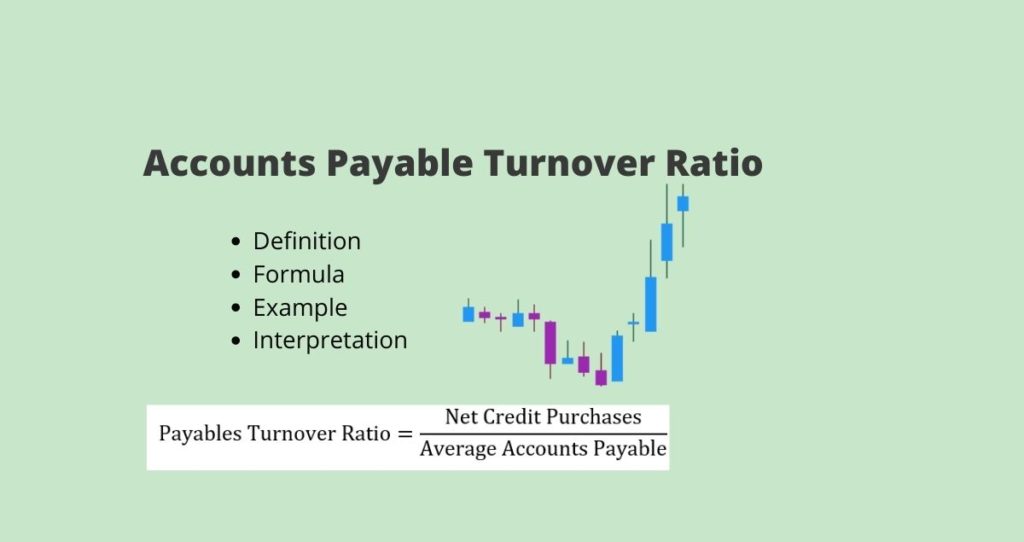

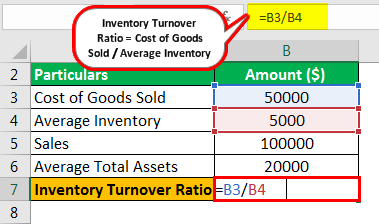

It is mathematically represented as the cost of sales divided by trade payables. Payable Turnover Ratio: This ratio shows how well a company can manage its supplier payments. Inventory Turnover ratio = Cost of Sales / Inventories. It is mathematically represented as the cost of sales divided by inventories. Inventory Turnover Ratio: This ratio shows how a company can convert its inventories into cash. Receivables Turnover Ratio = Revenue / Trade Receivable It is mathematically represented as revenue divided by trade receivables. Receivables Turnover Ratio: This ratio indicates how quickly a company can collect its receivables. Some of the major activity ratios are discussed below. It is mathematically represented as earnings before interest, tax, depreciation & amortization (EBITDA) divided by interest expense.Īctivity Ratio: These ratios assess a company’s ability to utilize available assets efficiently. Interest Coverage Ratio: This ratio indicates the capability of a company to pay off its financial expenses or interest obligations. It is mathematically represented as total debt divided by total assets.ĭebt-to-Asset Ratio = Total Debt / Total Assets It is mathematically represented as total debt divided by total equity.ĭebt-to-Asset Ratio: This ratio shows what percentage of the company’s assets are funded through debt financing. Some of the major leverage ratios are discussed below.ĭebt-to-Equity Ratio: This ratio indicates the capital structure, which shows the company’s dependency on the debt fund vis-à-vis its fund. Leverage Ratio: These ratios assess a company’s capital structure.

#Payable turnover ratio formula plus#

It is mathematically represented as cash & cash equivalents plus marketable securities divided by current liabilities. It is mathematically represented as current assets minus inventories and prepaid expenses divided by current liabilities.Ĭash Ratio: This ratio shows the percentage of the short-term liabilities covered by the most liquid assets (cash and other liquid marketable securities). Quick ratio: This ratio indicates the coverage of the short-term liabilities by the short-term assets, which are easy to liquidate. It is mathematically represented as current assets divided by current liabilities.Ĭurrent Ratio = Current Assets / Current Liabilities Some of the major liquidity ratios are discussed below.Ĭurrent Ratio: This ratio shows how well the short-term assets cover the short-term liabilities in cash, inventories, receivables, etc. Liquidity Ratio: These ratios indicate the short-term liquidity position of a company.

The formula for Accounting Ratio can be calculated by using the following steps: Operating Profit Margin = (Revenue – Cost of Sales – Operating Expenses) / Revenue Operating Profit Margin is calculated using the formula given below Gross Profit Margin = (Revenue – Cost of Sales) / Revenue

Gross Profit Margin is calculated using the formula given below Payable Turnover Ratio = $373,396 million / $46,092 million.Payable Turnover ratio = Cost of Sales / Trade Payables The payable Turnover Ratio is calculated using the formula given below Inventory Turnover Ratio = $373,396 million / $43,783 million.Inventory Turnover Ratio = Cost of Sales / Inventories Inventory Turnover Ratio is calculated using the formula given below Receivables Turnover Ratio = $500,343 million / $5,614 million.Receivables Turnover Ratio = Revenue / Trade Receivables Receivables Turnover Ratio is calculated using the formula given below Interest Coverage Ratio = $30,966 million / $1,978 million.Interest Coverage Ratio = EBITDA / Interest Expense Interest Coverage Ratio is calculated using the formula given below Debt-to-Equity Ratio = $39,040 million / $80,822 millionĭebt-to-Assets Ratio is calculated using the formula given belowĭebt-to-Assets Ratio = Total Debt / Total Assets.Cash Ratio = ($6,756 million + 0) / $78,521 millionĭebt-to-Equity Ratio is calculated using the formula given belowĭebt-to-Equity Ratio = Total Debt / Total Equity.Quick Ratio = ($59,664 million – $43,783 million – $3,511 million) / $78,521 millionĬash Ratio is calculated using the formula given belowĬash Ratio = (Cash & Cash Equivalents + Marketable Securities) / Current Liabilities.Quick Ratio = (Current Assets – Inventories – Prepaid Expenses) / Current Liabilities Quick Ratio is calculated using the formula given below

0 kommentar(er)

0 kommentar(er)