Through these new products, offshore investing becomes easier and more convenient for RCBC’s clients, as they need not open accounts and deal with various foreign brokers to achieve global diversification. In addition, with the growing number of sophisticated investors looking for further diversification, RCBC Trust is set this year to provide its high-net-worth individual customers and big corporate accounts a facility to invest in offshore equities via direct investment in global equities listed in selected exchanges or via global equity feeder fund. This product encourages employees to increase their personal savings by regularly setting aside funds from their monthly payroll to augment their retirement needs. The plan pools together employee contributions for collective investment and reinvestment in RCBC’s Rizal Peso Money Market Fund and is designed to make investing in Rizal Unit Investment Trust Funds affordable and convenient for company employees.

Its product range accommodates corporate needs such as automated payrolls and an electronic payment processing solution, while other products, such as internet banking via RCBC AccessOne provide customers with 24-hour banking access.Ī key offering in the corporate business area is RCBC’s Retail Employee Savings Plan launched in 2012. The range is diverse and seeks to cater to everyone from high-net-worth individuals to SMEs to entrepreneurial women.

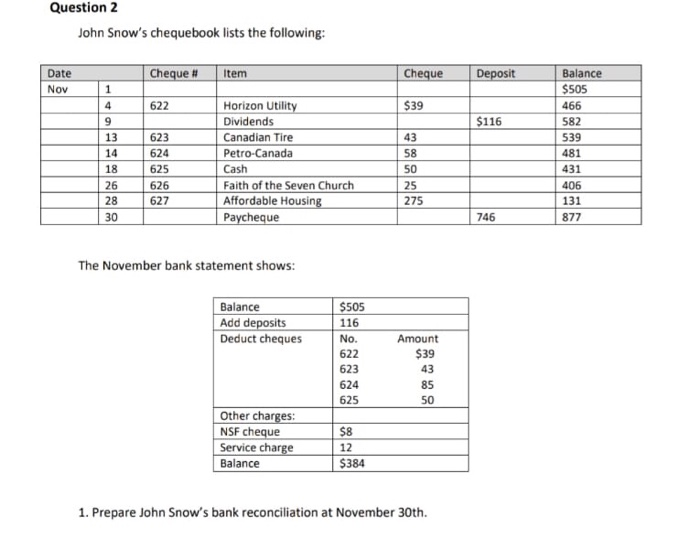

Rcbc chequebook balance series#

Since the migration to the new platform two years ago, RCBC has increased its daily transaction volume by 53 percent, from 980,000 in 2012 to 1.5 million in 2013, suggesting that customers have taken well to the new series of online and mobile products. Electronic banking also allows them to transact and go paperless, which is, obviously, a friendlier option in conserving environmental resources,” explained Florentino. This saves customers precious time, money and effort. “Given RCBC’s emphasis on electronic banking options for its clients, the bank is able to serve its customers’ needs through alternative channels, without them having to physically go to a traditional bricks-and-mortar branch. RCBC can now capitalise on a unified system to deliver consistent and superior services, better and new products, with faster time-to-market rollout, improved operations and administration processes with the cost greatly being reduced,” RCBC’s Head of Corporate Planning Gerald Florentino told World Finance. “RCBC is the first bank in the Philippines to migrate to a scalable, nimble and one-of-its-kind core banking platform. After RCBC migrated to the modern and sophisticated IT system, the bank has introduced new innovations that not only cater to the daily banking requirements of its customers but, more importantly, anticipate their banking needs. Having migrated to the core-banking platform Finacle in 2012, the bank has launched a series of ‘smarter solutions’, which refers to the wide range of products and services that it is now able to offer to its clients. Licensed for commercial and investment banking, the firm has gone from strength to strength in recent years, looking to accommodate a broad range of customers and grow its business in order to meet demand from new markets and an increasingly competitive domestic sector. The Rizal Commercial Banking Corporation (RCBC) is one of the country’s leading banks with about $10bn in assets and more than six million account holders. Looming ASEAN integration and an increasingly banked population is fostering the need for banking innovations as well as broad, industry M&A in order to bolster the sector against the capacity and experience of foreign actors.

The Philippines is looking at a banking revolution. Top 5 economic risk factors that must be considered.Top 5 ways that the finance industry can prepare for AI.Top 5 emerging fintech hubs across the globe right now.Top 5 ways that GDPR has impacted digital banking.Top 5 financial services that are ripe for automation.Top 5 ways to boost employee engagement and commitment.Top 5 most influential and inspirational US economists.Top 5 countries to be world’s next manufacturing hubs.Top 5 WFH habits, according to the world’s most successful business leaders.Top 5 keys to global economic recovery in 2021.Top 5 sustainability pioneers in Europe.Top 5 forces that will shape international finance in 2023.Payments made after 10:00 pm will be posted the next banking day. Fund transfer (from DBP to DBP account only)Ĭut off time is 10:00 pm daily.Checkbook request (for Checking Account).The DBP ATM has truly evolved! From being simply a machine that dispenses cash for your withdrawals or provides you with your account balance, DBP ATM allows you to do much more… Maximum amount of ATM withdrawal per day – P20,000.00 Maximum amount per ATM withdrawal transaction* – P20,000.00

Maximum number of ATM withdrawal transaction per day – Five (5)

0 kommentar(er)

0 kommentar(er)